There’s a growing call in OWS for a debt strike. What does that mean? It means using the call to refuse debt as a means to make debt public. There should be a public discussion about how endebted we all are within the debt square that has replaced the public square. It means overcoming our shame at being locked in the debt square. And it means taking the debt public set people free. That last is not a demand because we all know no legislature at present is going to enact it. Look at Montreal, though: the government has not listened to the popular will and the people have not backed down. It’s public.

What is the debt square? It is the space defined by the four corners of modern US life:

- student debt ($1 trillion)

- mortgage debt ($14.6 trillion)

- credit card debt ($800 billion)

- medical debt (unknown)

Mortgage debt has declined slightly from $14.6 trillion in 2008 to $13.4 trillion at the end of 2011. The real change is in the amount of mortgage debt held by the federal government in various ways. From $725 billion in 2007, it’s now over $5 trillion. That means that the Feds control close to 40% of mortgage debt.

You hear less now about foreclosure because banks are short-selling houses and taking a loss:

All told, 233,299 bank-owned homes or those in some stage of foreclosure sold in the first quarter, making up 26 percent of all U.S. home sales in the period

As for credit cards, it’s what you already know: debt is rising, as are interest rates. Credit card debt snuck over $800 billion last year, even as interest rates rose to over 12% on average. The average credit card in households that have them is now over $15,000. Fewer people do have cards, as credit is being denied more often, but people who have credit cards have 3.5 each on average.

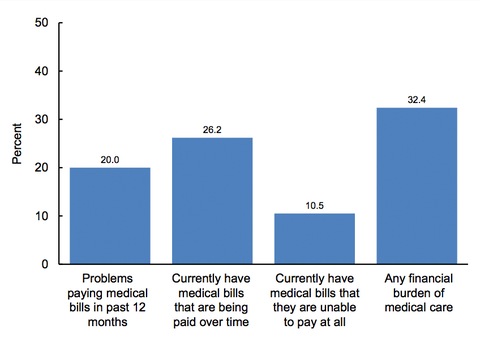

Increasingly, people are using credit cards to “pay” their medical bills, which is the third corner of the debt square. One in three households are struggling with medical bills and eighty per cent of those questioned for a PBS Newshour survey were having issues with financing health care.

If that seems a little abstract, here are some hard numbers:

If that seems a little abstract, here are some hard numbers:

As of 2010, 73 million people reported problems paying their medical bills or were paying off medical debt, up from 58 million in 2005. An estimated 44 million people were paying off medical debt in 2010, up from 37 million in 2005. (Source: Press release, The Commonwealth Fund, March 16, 2011.)

The least surprising news story of June 2012 will be the Supreme Court decision to revoke the Affordable Health Care Act, setting back even those modest improvements to health care affordability. But note that the Commonwealth Fund also found that

Sixty-one percent of those with medical debt or bill problems were insured at the time care was provided.

There is little available recent data on medical debt and no collated national figure that I could find.

Student debt has been the most widely discussed form of debt here. Today NYU President John Sexton announced:

Undergraduate tuition, fees, and room and board – For the 2012-13 academic year, we have budgeted an increase of 3.8% in tuition and mandatory fees, and 3.5% in room and board; the aggregate increase in the cost of attendance will be 3.8%.

So that $1 trillion of student debt is going to keep rising beyond the rate of inflation yet again.

The debt square defines the aspirations of most citizens: health, education, shelter, consumer goods. It defines them as things you need or want but renders the means of obtaining them into an object of shame. Who hasn’t stayed awake at night worrying about one or other of these debts? The answer to that question is now simple: the one per cent.

What is the answer to the prison of the debt square? To make it public. As we can see with mortgages, the so-called free market wants to move non-prime debt to the public sector anyway. With public money so cheap, the government could take on all private debt and have us reimburse them at the one percent rate it charges banks. Or it could just abolish the debt altogether.

That government is not this government that we have now. It is the government that the students in Quebec want. It is, more exactly, not a government at all but a means of enabling the possibility of autonomous citizens. To get there, we have to imagine not just a world without student debt, but one in which you are not a loan. A life to be lived rather than a credit rating to be lived up to: debt strike!

Most informative, thank you.

Another aspect of debt, of course, is bankruptcy, after which you simply have to do without either food, shelter, or medicine.

The only thing worse than bankruptcy is student debts which cannot be cleared in bankruptcy… ever. These debts follow you beyond the grave. Unlike bankruptcy in which your credit ratin is restored after 10 years, student debt continues to mount and your credit is ruined forever,

!

I am SO interested! Please send me any and all info. Thanks!

It’s quite right to stress that student debt has no bankruptcy protection: which is one reason lenders are so keen on it.

There are debt assemblies this weekend in NYC: Sunday June 10 in Washington Square Park at noon.